REPORT: How Five Years Shaped the Future of UK Manufacturing

UK manufacturers have demonstrated amazing adaptability during a period of unprecedented major disruption, according to a new report published by Protolabs and the Institute of Mechanical

Concerns about Covid-19 are down, but inflation worries are up.

The world looked a lot different in the fall of 2021.

Back then, COVID-19 was a top concern for more than half of respondents in our September 2021 survey. Today that number is down to 17%, according to our Annual Quality Spending Survey, which surveyed subscribers in September 2022.

While current events continue to change, the spending categories remain remarkably stable. Year after year respondents want their CMMs, scanners, and software. These products continue to be in demand every year, but of course, new technologies are joining the fold. Almost every emerging technology category saw an increase—from additive manufacturing to APIs—whether respondents are using them now or just beginning to plan for them.

Clear Seas Research, in conjunction with Quality, conducted the 22nd Annual Spending Study in order to determine actual spending for quality assurance and control equipment, systems, software, and services compared to the projected/budgeted amount as well as the change in budget allocation within quality equipment and service categories. And finally, we wanted to get a pulse on the quality professional themselves and see how their approach to quality today compares to a year ago.

Before we examine what quality professionals will be purchasing and why, let’s take a look at who responded. For almost two-in-three respondents, the top manufacturing operation at their location is assembly. Next comes machining, done at nearly half of locations.

Respondents come from locations with an average of 415 employees, with 74% of company locations employing fewer than 250 employees.

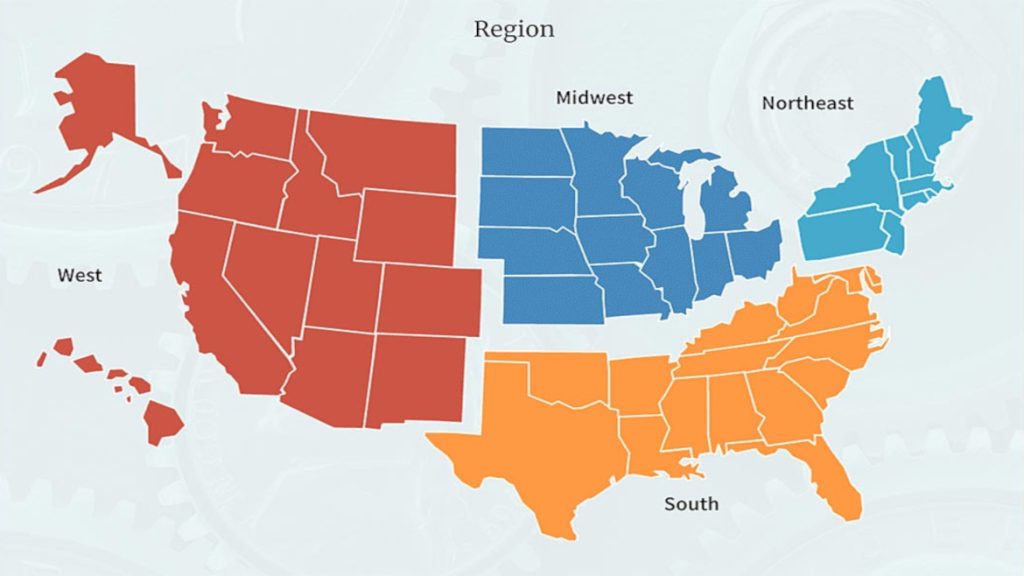

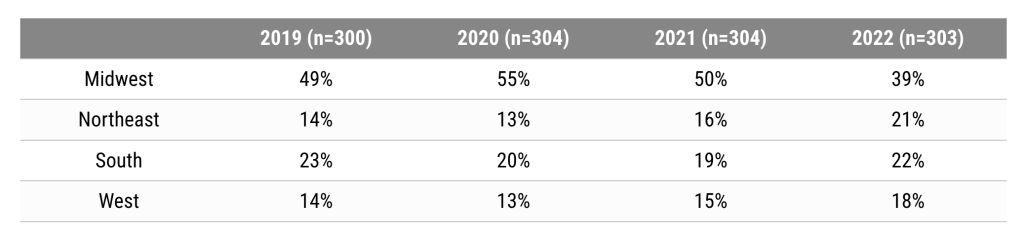

These locations are scattered across the U.S. This year 39% of respondents came from the Midwest, 22% from the South, 21% from the Northeast, and 18% from the West.

What are they making? The largest number of respondents came from companies in aerospace products/parts manufacturing, medical equipment and supplies manufacturing, plastics and rubber products manufacturing, and fabricated metal product manufacturing.

Respondents themselves came from quality management (34%), along with quality engineering, corporate management, manufacturing engineering, and manufacturing management/operations. Other categories included research and development, technical engineering and purchasing.

More than half of respondents reported that their 2023 budget had already been started as of mid-September, and many were on their way to finishing.

Three-quarters of respondents report that they will have an approved quality equipment/services budget for fiscal 2023 in 2022, with 58% finalizing this in the fourth quarter of 2022. Twenty-one percent finish in October, 19% in November, and 18% in December.

But if you are still working on this year’s budget, you are not alone. Twenty percent will be finalizing their budget in the first quarter of 2023. Twelve percent of respondents will finalize their 2023 budget this month, 6% next month, and 3% in March.

We’ve looked at the timing and the reasons for the investments, but now let’s look at what respondents plan to buy.

General-use test/measurement/inspection equipment, test/measurement/inspection services, and/or gages/gaging systems top the list of purchases for fiscal 2023.

The list goes on. Other planned purchases include: product testing equipment, software, consulting and training services, optical inspection and measurement equipment, materials test equipment, nondestructive test equipment, form and surface measurement equipment, CMMs, and color and coating thickness measurement. Ninety-six percent of respondents said they plan to purchase at least one of these items.

Let’s look into these product categories more closely, starting with one of the quality workhorses—a CMM.

Seventeen percent plan to purchase a CMM, and CMM spending looks set to increase. Almost half of respondents predict their company will spend $100,000 or more on a CMM in 2023, which is higher than budgets set in this category for 2022.

In terms of form and surface measuring equipment, the budget is less than $5,000 for almost a third of respondents. Spending for 2023 is predicted to remain the same.

Gages are a staple of a quality program and the budget reflects this. Budgets for gages and gaging systems for 2022 and 2023 look similar, with the majority of respondents budgeting under $60,000. Handheld gages lead the gaging budget with 27% slated for them. Custom/specialty gages, a new category in 2021, jumped from 7% to 13%, making them the number-two category. Fixture and special tooling gages, thread gages, plug and ring gages, thickness gages, bore gages and depth gages are next. Air gages, turnkey and in-process gaging systems, fixed limit gages, snap gages, gear and spline measurement, and ball gages round out the list.

Forty percent of respondents budgeted less than $10,000 for optical inspection and measurement equipment in 2022. Fifty-nine percent expect this year’s budget for this equipment will remain the same, and 35% expect an increase. Twenty-four percent of this category will be spent on machine vision systems.

The budget for color and coatings thickness equipment is anticipated to be similar to 2022. Three-fifths of respondents’ companies budgeted less than $10,000 for this equipment in 2022, and spending for 2023 looks like it will follow this trend.

Material testing equipment looks poise for a jump. One-third of respondents expect to see an increase in spending on material testing equipment next year, which is higher than last year’s predictions. Hardness testing leads this category at 17%.

In terms of nondestructive testing (NDT) equipment, the majority (77%) expect their spending to remain the same. For about half of respondents, the 2022 budget for this equipment was $10,000 or less, and this looks set to continue this year. Ultrasonic testing lead the category with 17% of the NDT budget.

For general-use test, measurement and inspection equipment in 2022, three-quarters of respondent companies budgeted less than $60,000. For most, 2023 will bring a similar pattern. Calibration equipment dominates the category, taking up half of this budget.

Nothing gets done without software, and more than half budgeted less than $20,000 for this item. This looks set to continue in 2023.

For consulting and training, the majority of respondents expect no changes; Seventy-nine percent anticipate the 2023 budget will remain the same. Twenty-eight percent of this budget will be spending on certification/registration. Quality management and process improvement are slated for nearly one-third of this budget.

UK manufacturers have demonstrated amazing adaptability during a period of unprecedented major disruption, according to a new report published by Protolabs and the Institute of Mechanical

The 29th of April 2024 is an important date for IoT manufacturers and anyone selling connected devices in the UK. This brand new and world-leading

Dave Treadwell, VSUK Quality Manager and subregion Coordinator for VSNE covering Holland and Germany, takes us through his experience of becoming a CQI Fellow and

Temple QMS is delighted to be supporting the roll out of new grant funding in the Shropshire region. We will be supporting SME manufacturing businesses